Diwakar Mohan

Finance & Credit Manager

Professional Summary

Professional Experience

Finance Manager

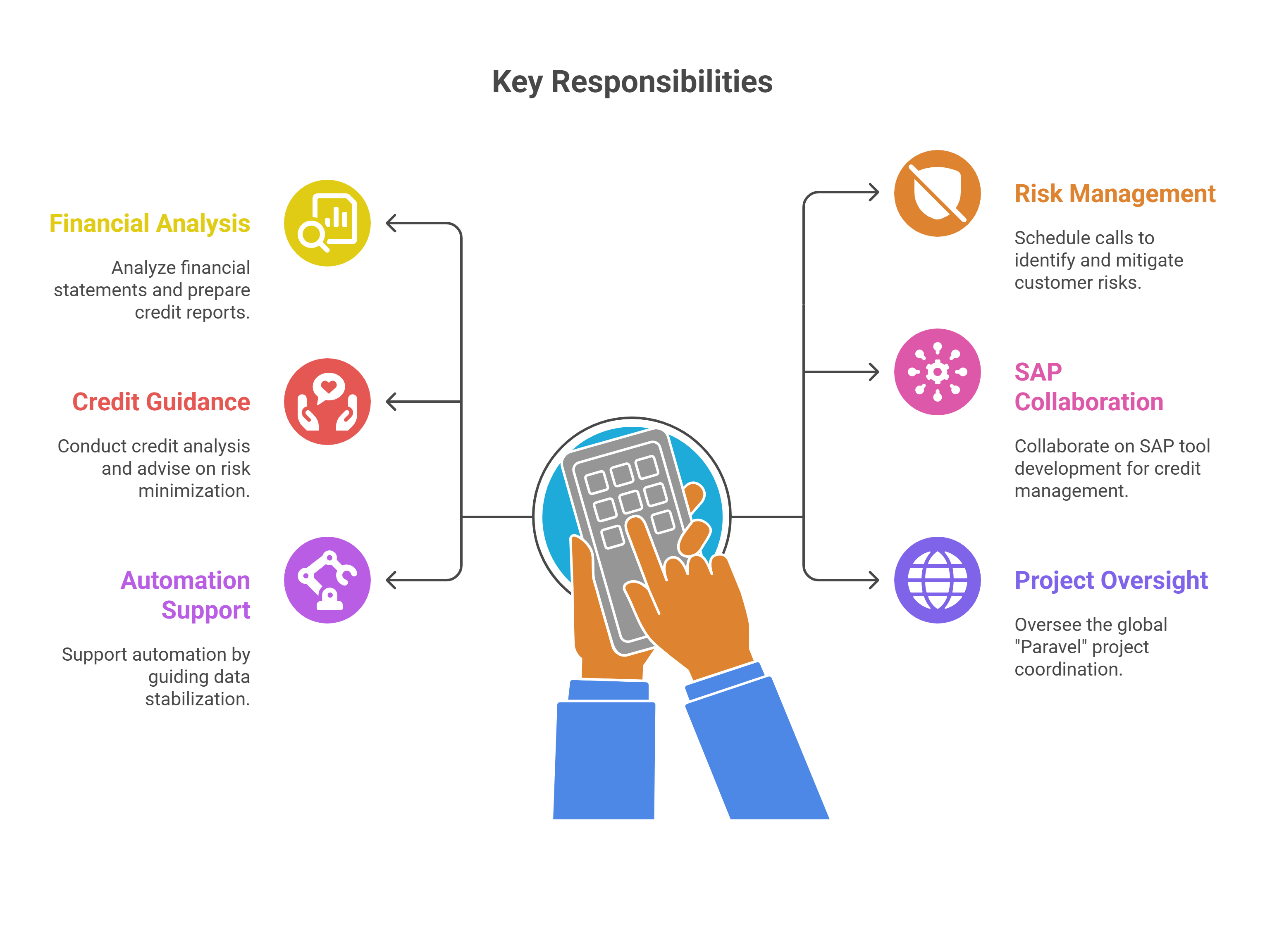

- Analyse Balance Sheets, Income Statements, and Cash Flow of customers and prepare credit reports

- Schedule and lead calls with Regional Business Units to identify risks and mitigation of customers

- Conduct credit analysis and provide optimization guidance to RBU

- Collaborate on SAP tool development for Collection, Dispute, and Credit Management by providing essential inputs

- Support automation efforts by guiding data stabilization and creating live dashboards for the treasury team

- Oversee the global "Paravel" project, coordinating between SAP/IT teams and Regional Business Units

FP&A Manager

- Managed multiple project migrations and built a team of 32 members specializing in Financial Analysis and Credit Review

- Responsible for recruitment, training, SOP development, production, quality, and employee welfare processes

- Directed 3 teams handling 5 projects for Banking clients in Ireland and the UK, including Customer Financial Analysis (CFA), Corporate CFA, and Credit Review

- Migrated projects to NTT Data and ensured team readiness and ramp-up through structured training and monitoring

- Streamlined processes to convert unstructured financial data into structured information for IFRS standards

- Integrate credit reviews by integrating data from Inbox Management, Exposure Aggregation, Loan Data Capture, and CFA process

- Conducted Credit Analysis, including loan repayment assessments, covenant testing, and security valuation, in line with client Banking norms

- Performed financial analysis, ratio analysis, and comparative studies to evaluate customer financial positions and repayment capacities

- Valued tangible and intangible securities across sectors such as General Industries, Property Investments, and Agriculture using multiple valuation methods

- Delivered insights on creditworthiness and ensured compliance with bank norms through comprehensive credit reviews and risk assessments

Credit Specialist

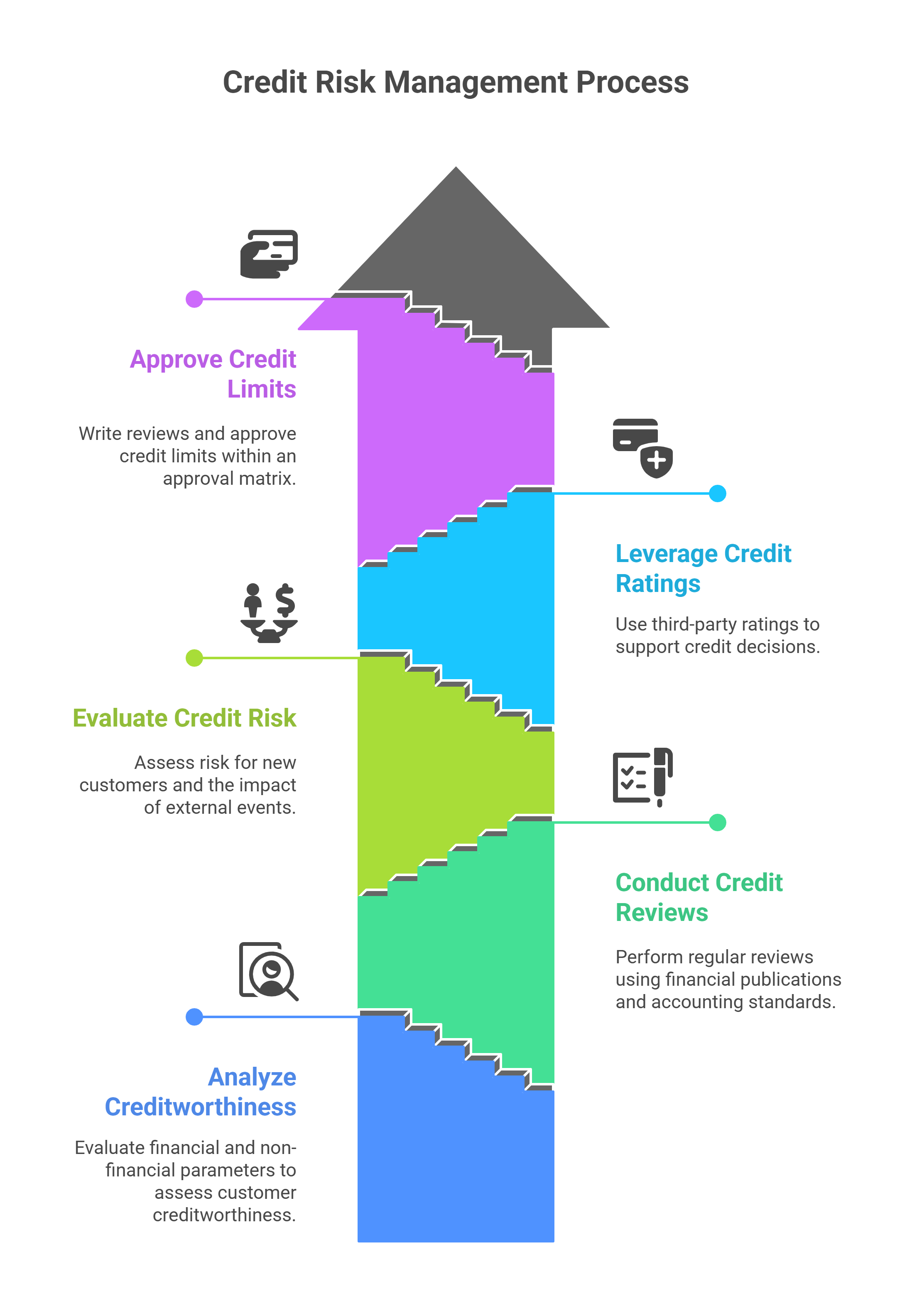

- Analyse customers' creditworthiness based on financial and non-financial parameters, including ratio analysis, trend analysis, peer analysis, industry analysis, and financial forecasts

- Perform quarterly, half-yearly, and annual credit reviews using risk and 10Q publications while adhering to US GAAP and IFRS standards

- Evaluate credit risk for new customers and assess the impact of industry and economic events on their operations

- Leverage third-party credit agency ratings such as Frisk Score, S&P Rating, Moody's Score, and DNB Paydex to support credit decisions

- Write detailed credit reviews and approve credit limits within an approval matrix, handling customers with limits ranging from USD 10K to USD 2B

Research Analyst

- Conducted detailed research profiling influential individuals/entities using major search engines

- Developed a bespoke KAPOW for information extraction from websites and databases

Education

MBA - Finance & HR

B.Com

Languages Known

| Language | Read | Write | Speak |

|---|---|---|---|

| English | ✓ | ✓ | ✓ |

| Tamil | ✓ | ✓ | |

| Kannada | ✓ | ||

| Hindi | ✓ |

Skills & Expertise

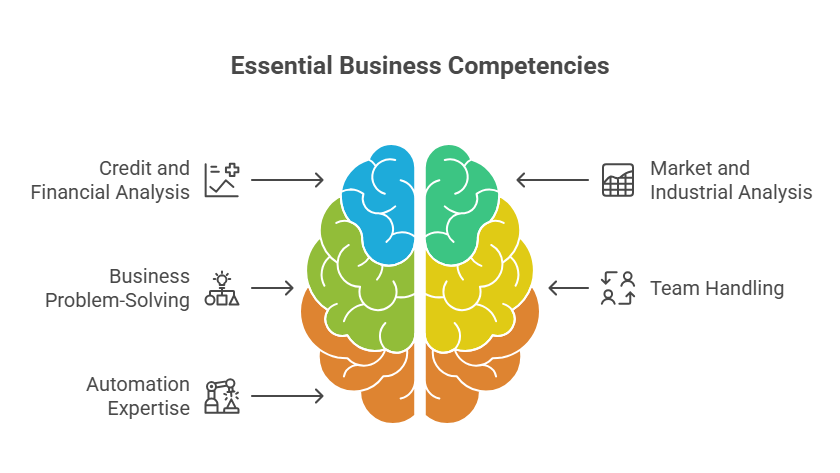

Credit & Financial Analysis

- BS, IS & CF Analysis

- Peer, Ratio, Variance Analysis

- Comparative Analysis

- Forecasting & Budgeting

- US GAAP & IFRS Standards

Market & Industrial Analysis

- Market Research & Analysis

- Industry Trend Analysis

- Competitive Analysis

- Risk Assessment

Business Problem Solving

- Process Optimization

- Strategic Planning

- Risk Mitigation

- Decision Support

Team Handling

- Team Building & Management

- Training & Development

- Performance Management

- Cross-functional Collaboration

Business & AI Tools

- Power BI

- Power Automate

- Windsurf IDE

- n8n (Automation)

- Google AI Studio

- Claude AI

- Excel VBA

- RPA & Python Automation

Automation

- Process Automation

- Workflow Design

- Dashboard Development

- Data Integration

Cover Letter

Atos Global IT Solution and Services Private Limited

Brief on Roles & Responsibilities

I am responsible for validating balance sheets and income statements across various regions to prepare comprehensive credit reports for new customers. This includes coordinating with Regional Business Units to assess high-risk customers, providing strategic guidance to mitigate risks, and conducting detailed credit analyses as needed. Additionally, I contribute to the development of SAP tools focused on Collection Management, Dispute Management, and Credit Management, ensuring seamless communication of all required inputs for successful tool development.

Furthermore, I support the automation team in creating visual dashboards for the treasury department, offering guidance to stabilize data and transform it into dynamic, live dashboards.

NTT DATA Information Processing Services Pvt Ltd

Managed three teams across five projects for banking clients in Ireland and the UK, focusing on Customer Financial Analysis (CFA), Corporate CFA, and Credit Review. Successfully migrated these projects to NTT Data, building a high-performing team of 32 members and implementing SOPs, training programs, and employee welfare initiatives to enhance production quality and minimize attrition.

- Customer Financial Analysis (CFA): Streamlined unstructured financial data into actionable insights for SMEs, ensuring compliance with US GAAP and IFRS standards. Led reconciliation of financial statements and provided hands-on training for new associates during ramp-up periods.

- Credit Review: Oversaw creditworthiness assessments involving Inbox Management, Exposure Aggregation, and Loan Data Capture. Ensured adherence to banking norms and BASEL regulations, covering Current Account Operations, Loan Clearance, and Covenant Testing.

- Financial Analysis & Repayment: Conducted detailed analysis of customer financial positions, focusing on Ratio Analysis, Cash Flow Statements, and Loan-to-Value assessments. Evaluated tangible and intangible securities across diverse sectors using comparative, yield, and rental valuation methods.

FLEX (Formerly Flextronics Technologies (I) Pvt Ltd)

Experienced in analysing customer creditworthiness based on financial and non-financial parameters to determine credit limits for trade purposes. Expertise includes Ratio Analysis, Comparative Analysis, Trend Analysis, Peer Analysis, Industry Analysis, and Financial Forecasting. Skilled in interpreting third-party credit agency ratings, such as Frisk Score, Credit Risk Monitor Score, Z Score, S&P Rating, Moody's Score, and Fitch Score.

- Conduct quarterly, half-yearly, and annual credit reviews by analyzing customer financials, including 10K and 10Q publications.

- Assess credit risk for new customers, staying informed about industry trends and economic events.

- Perform financial analyses per US GAAP and IFRS standards.

- Specialized knowledge in Australian Solar Projects, including QBE Insurance, NCI Brokerage, and PPSR application.

Handled credit reviews for a diverse customer base, from SMEs to large corporations, with credit limits ranging from USD 10K to USD 2B, ensuring adherence to best practices and mitigating risks effectively.

NG Connectivity Data System (D/B/A: Relsci)

Worked as a Profile Writer, specializing in profiling influential individuals and entities in the U.S. and globally, delivering high-quality information to clients. Conducted detailed research using credible sources such as Forbes, Wikipedia, and BusinessWeek to collect data for software implementation.

Contributed to projects including Profile Writing, SEC, Linking, Extraction & Mining, and KapowKatalyst (with a primary focus on Kapow). Promoted to Quality Control (QC) within just seven months, recognizing exceptional performance and attention to detail.

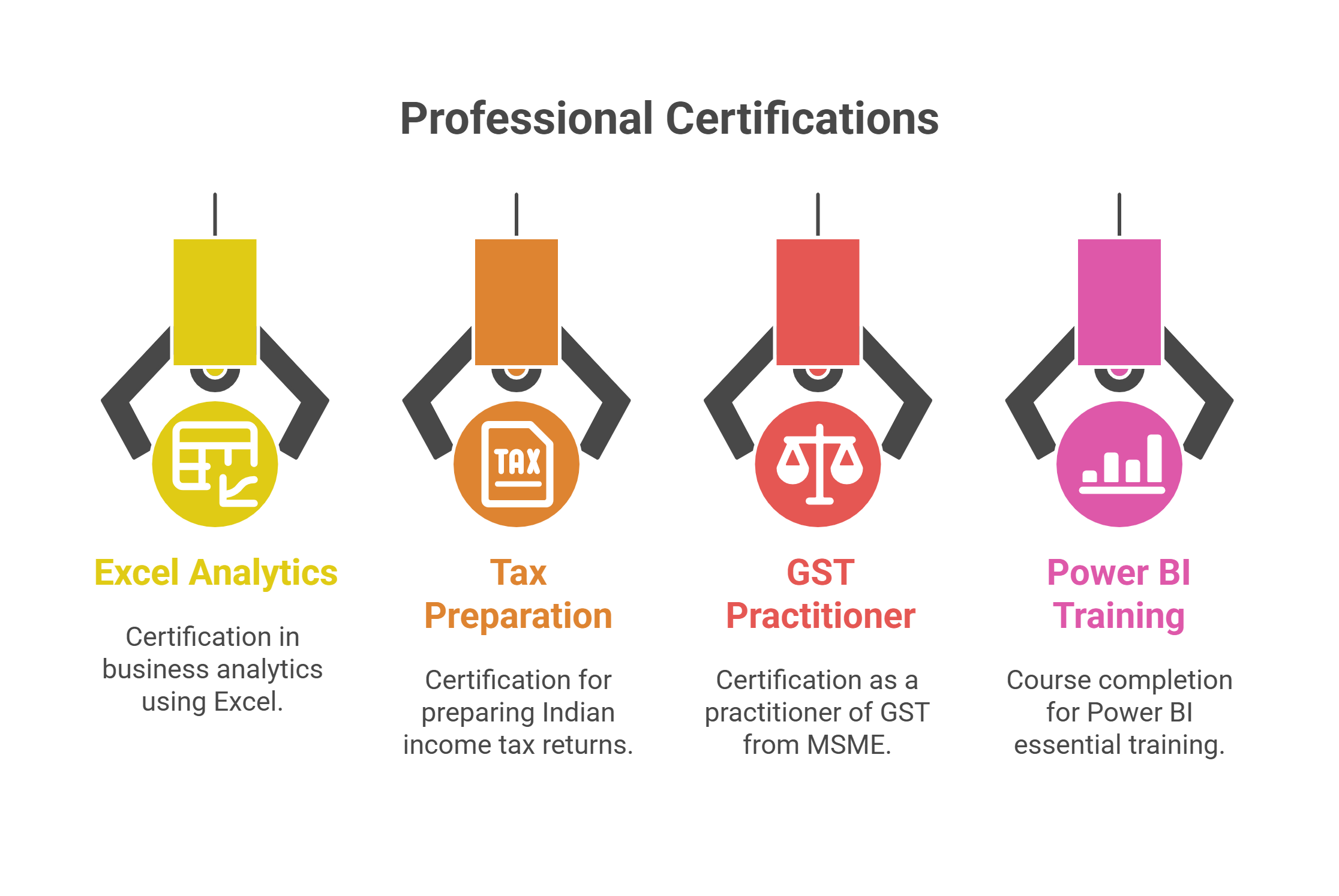

Certifications & Achievements

Featured Projects

Automation Project Demo

Financial Automation with AI - PDF Data Extraction

Financial automation project demonstrating AI-powered PDF data extraction